Workforce Wrap Up: June Edition

Slower consumer spending, $5 value meals, and labor market "new normal"

By: Jomayra Herrera

I hope everyone had a lovely Fourth of July weekend! As a Florida resident, it’s one of my favorite times of year - nothing is better than sun, BBQ, fireworks, and celebrating the great country I get the privilege to live in.

ICYMI last month I started a monthly series called Workforce Wrap Up that aims to give a quick 5-minute download of interesting highlights that happened in our labor market / economy in the past month. It’s not meant to be exhaustive (that’s what a Bloomberg subscription is for) but more so tidbits and data points that I found interesting. So, with that, what happened in June?

Labor market added 206K jobs in June, keeping unemployment at a steady 4.1%.

Similar to prior months, employment was driven by jobs in government, healthcare, social assistance, and construction.

April and May employment was revised down by 111,000 combined, bringing the three-month average of job gains to 177,000, down from the 269,000 average in the prior three months.

That said, average hourly earnings increased by 0.3%, up 3.9% since last year. And the labor force participation rate among prime-age workers rose to 83.7%.

Given data suggesting a cooling labor market and inflation, CME’s FedWatch tool puts the probability of a rate cut at the September meeting at 77%.

Layoffs are relatively stable at 1%, so most deceleration is thankfully happening from fewer job openings as opposed to workers getting laid off. We hope this trend continues.

Consumers are expecting the labor market to continue to decelerate.

Affordable value meals are making their way back amid slower consumer spending.

As pandemic savings are diminishing, the US consumer is increasingly more price sensitive. McDonalds recently announced they are launching a $5 value meal. Competitors are watching as Wendy’s also released a $3 breakfast offer and Starbucks released a $6 breakfast sandwich and coffee combo.

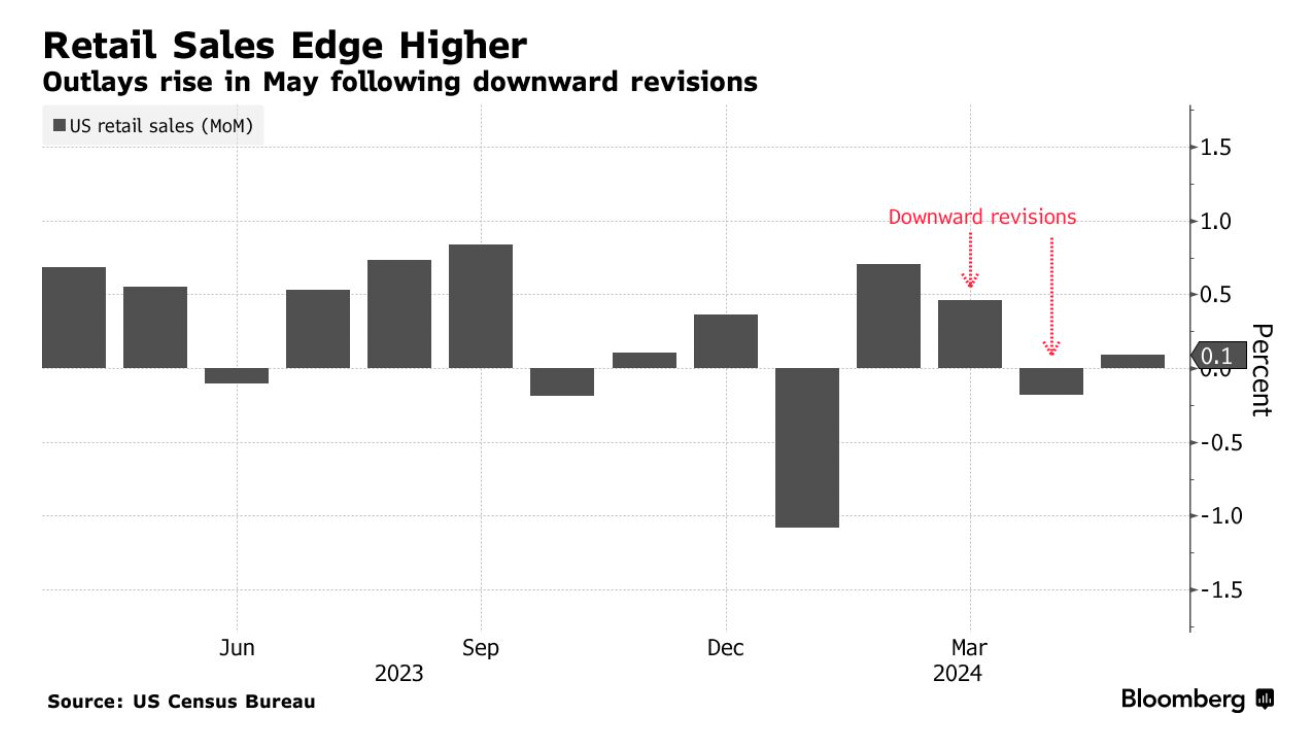

Retail sales growth came back lower than initially anticipated (0.1% instead of 0.3%), suggesting consumers are pulling back on spending faster than expected.

When adjusted for inflation, the largest decline in retail sales happened in housing-related purchases and food.

Believe it or not, groceries are actually getting cheaper for the average American. A new report by the White House Council of Economic Advisers found that while grocery prices are still high relative to the pandemic, wages have also increased so it takes about the same amount of hours (3.6) for an average worker to buy a week’s worth of groceries as in 2019.

27% of the grocery basket saw price declines over the past year, about the same as the average since 2000.

The report applauds major grocers like Target, Aldi, and Walmart for announcing price cuts.

The Congressional Budget Office released a somewhat dreary budget and economic outlook for 2024 to 2034. But there’s one silver lining - immigration.

In CBO’s projections, the deficit totals nearly $2 trillion in 2024 and large deficits push federal debt held by the public to 122 percent of GDP in 2034.

Economic growth is expected to slow to 2.0 percent in 2024 and 1.8 percent in 2026 and later years.

That said, CBO projects net immigration of those without work authorization is on track to be 8.7 million greater than previously forecast from 2021 to 2026. This surge would cause GDP to be $9 trillion higher over the coming decade, lower deficits by $990 billion over the next decade, and increase federal revenues by $1.2 trillion.

What it’s important to watch is how each of the upcoming presidential candidates will handle immigration, as it will be a key lever in helping to spur or decelerate economic growth.

A new McKinsey report suggests a tight global labor market may be the “new normal” - and without advances in productivity and/or initiatives to increase labor supply it will have negative implications for economic growth.

The labor surplus has fallen from 24 million to 1 million since 2010 in eight advanced economies.

The number of job vacancies per available worker in the U.S. increased by almost seven times between 2010 and 2023. It’s increased by 4.2x in aggregate across 30 advanced economies in their analysis.

GDP could have been higher by 0.5 to 1.5 percent in 2023 if there were fewer excess vacancies.

Sectors with higher productivity growth represented a decreasing share of job vacancies. Looking forward, this creates even more pressure for Gen AI to fulfill its promise of improving productivity given the lack of labor to drive economic growth.

As an aide, it’s research like this that makes me so excited about the work we are doing at Reach to help invest in the future of work. We invest in companies like Stepful that create net new supply in critical healthcare sectors, WorkWhile that increases liquidity in high-demand hourly jobs, and Replit that helps to augment developers. We are always looking for any tool or company that creates new supply, helps increase labor liquidity, or improve productivity, especially in critical sectors within the economy.

Unions are seeing a resurgence in the US - will this lead to stronger worker protections?

Workers are voting to join unions at the highest rate in 15 years according to a new report by the Center for American Progress.

After a decline in the number of elections under the Trump administration, workers held more than 1,700 elections for union representation in 2023, with over 115,000 workers voting. This is the highest number of elections since 2010.

Union certification is the first and very important hurdle. The trend to watch is how workers successfully bargain with their employers.

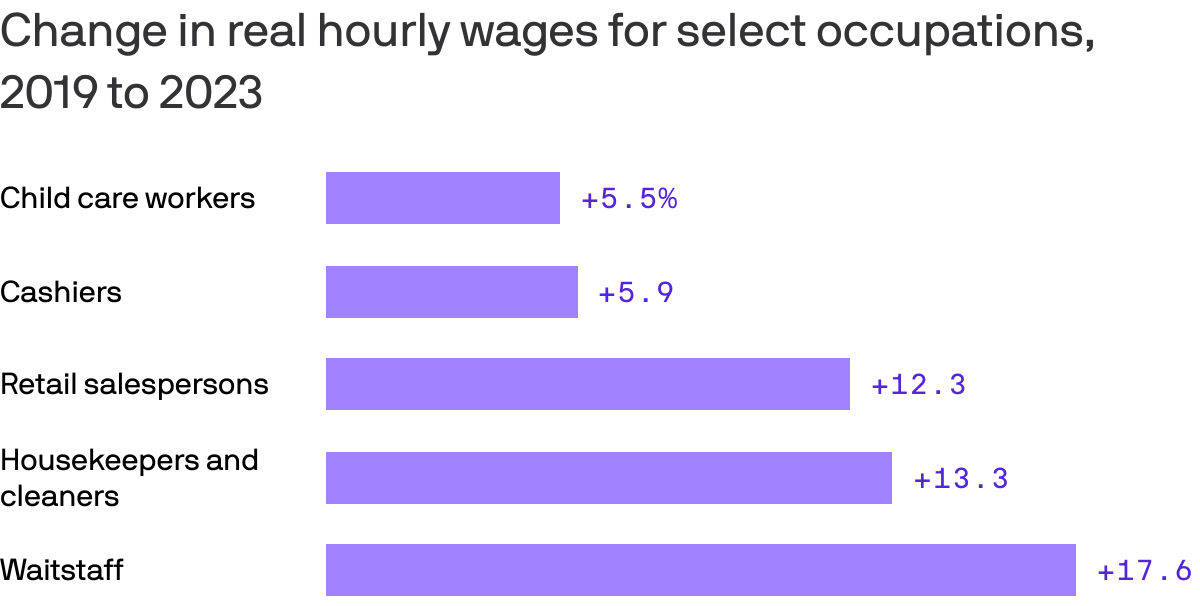

Most frontline workers saw relatively large hourly wage gains over the last few years - except for one noticeable exception, childcare workers.

The Chicago Fed released a new analysis finding the number of childcare workers remained 9% below its pre-pandemic level as of year-end 2023.

This is an existential problem, because we need to increase access to childcare in order to enable increased labor force participation (to the point above).

The challenge is that childcare work is not easy and it’s also not well compensated, making the job relatively unattractive. The median wage is $14.60 an hour, in the bottom 5% of all occupations.

Moreover, relative to other frontline / lower wage occupations, childcare workers saw some of the slowest growth in their real hourly wages since 2019 (average of 5.5% compared to 12% for retail or 17% for waitstaff).

So with high demand, why don’t we see similar wage increases as other sectors? Well, unlike restaurants or hospitality that have a wide range of clientele, the customers of childcare tend to be young parents with real constraints on their ability to pay. I’m interested to see how new companies like Tandem that help to make childcare work more flexible can help to improve liquidity in this market.

If you made it to the end, I hope you found this interesting. If you have any feedback on data you want to see or dive deeper on, let me know by emailing me at jomayra@reachcapital.com. And, as always, if you are building a company that is helping to address challenges around increasing labor supply, improve labor productivity, or making the lives of workers better, please reach out.