Workforce Wrap Up: May Edition

Strong jobs report may mask some cracks in the economy's foundation

By: Jomayra Herrera

ICYMI last month I put together a write up on the April jobs report. I had a lot of fun doing it, so I decided to make a monthly series - welcome to the new Workforce Wrap Up!

Here’s a download of what we learned in May

The economy added 272K jobs in May blowing past initial estimates of 190K jobs, but the underlying numbers are a bit muddled, suggesting future downward revisions.

According to BLS, the employment increases were driven by healthcare, government, leisure & hospitality, and professional, scientific, and technical services.

But the household survey (which surveys households instead of payrolls from businesses) showed employment decreased by 408K, with a concentration in the 16-19 age cohort. This suggests there may be downward revisions in the next jobs report.

Job openings are declining but layoffs and unemployment are stable and still at historical lows.

April Job Openings and Labor Turnover data showed the number of job openings fell by 296,000. The rate of openings has decreased from 6% to 4.8% in the last year.

There are now 8.1 million vacant jobs vs 11.5 million two years ago. There are 1.2 job openings per unemployed worker.

But the number of people losing their jobs actually decreased in April and the rate (1%) is lower than it was a year ago.

The cooling does mean that it is more of an employer’s market, especially for white-collar jobs. In fact, only 1.3% of 68 million white-collar professionals were promoted in the first three months of the year, the lowest rate for any first quarter in over five years.

This is the best outcome to cool the labor market, as it’s driven by fewer job openings as opposed to massive layoffs.

And who is participating in the labor force is expanding.

In May, 75.7% of all women 25–54 were working, which is a record high. They have now regained their pandemic losses in the job market and have been exceeding those numbers month after month.

And the employment-to-population ratio for Americans with disabilities continues to increase.

These are important trends because having additional labor supply helps with inflation reduction efforts.

Inflation is finally showing some early signs of cooling.

The Personal Consumption Expenditures Price Index showed a deceleration in core inflation with prices rising 0.2% in April versus 0.3% in February and March.

Wages did not rise as quickly as inflation did. Real disposable incomes fell 0.1%, the second decline in three months.

If you zoom out, core inflation is still running at 4.1% annualized pace, which is well above the 2% target, suggesting uncertainty around when a rate cut might happen.

But there is a large and growing gap between how Americans assess their own finances and that of the country.

72% of Americans claim that they are doing at least OK financially but only 22% agree that the national economy is either good or excellent.

To add to this, only 22% of Americans in the May Gallup poll said they were satisfied with the way things were going in the U.S., compared to 77% dissatisfied. This is a wider gap than three-quarters of the time since they started asking the question in the 70’s.

Consumers are starting to slow down their spending.

Consumer spending increased 0.2% in April, versus 0.7% in February and March.

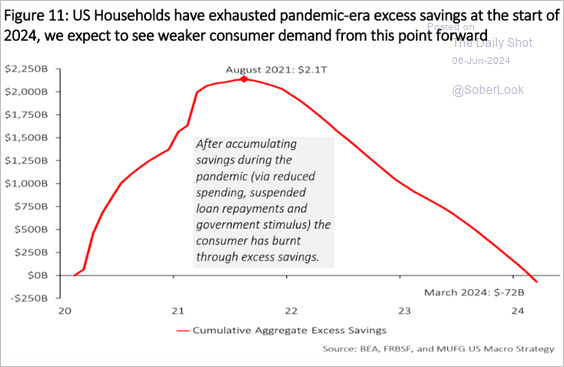

Spending is decreasing in the “fun” items like recreation, clothing, and footwear along with some of the more painful drivers of inflation like gasoline. Some data indicates that US households have spent pandemic-era excess savings.

While inflation may be cooling down, it’s important to remember that the average American doesn’t necessarily feel that on a day-to-day basis. For example, prices for items like fast-food continue to outpace wage gains for employees.

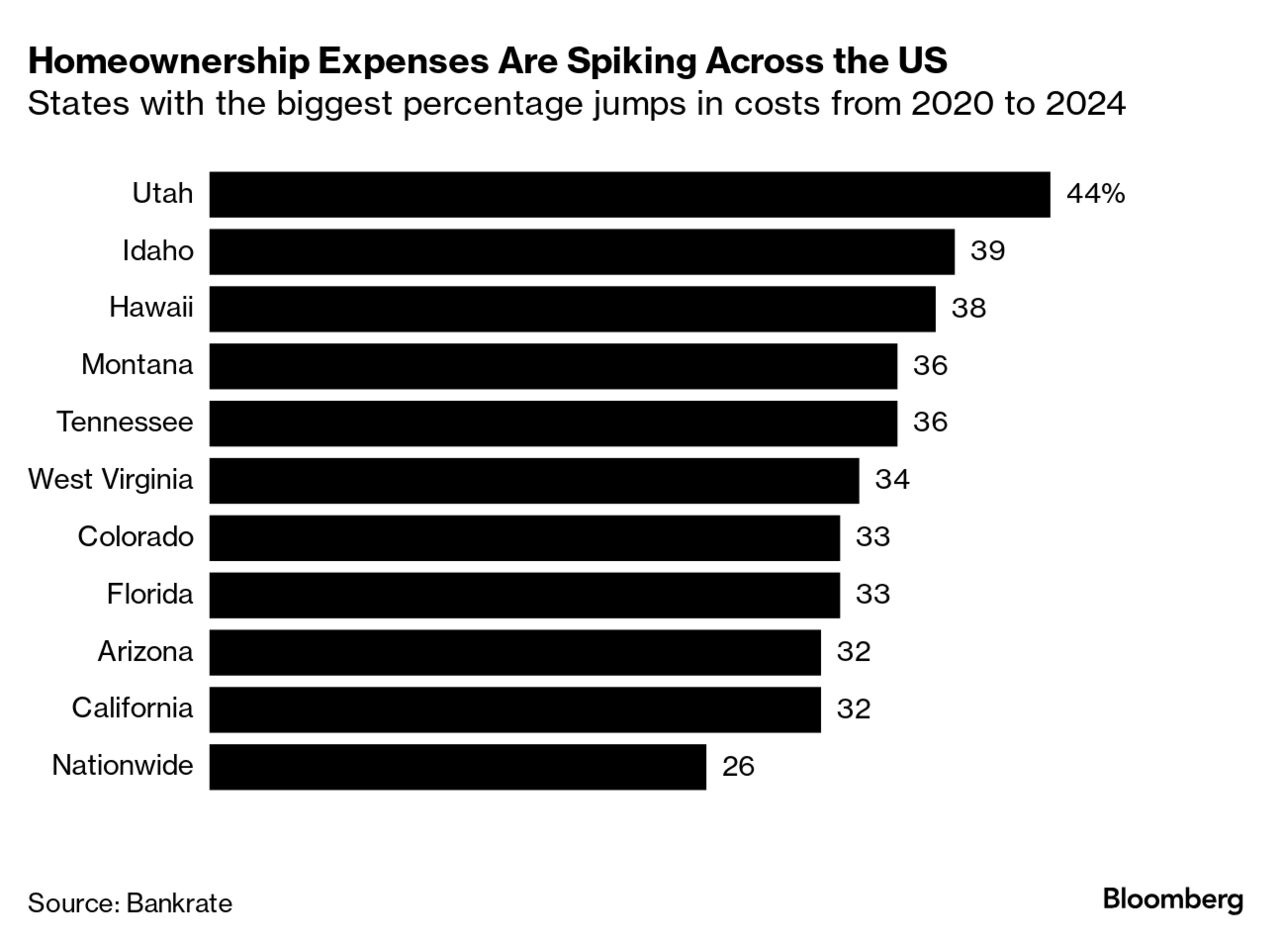

Lastly, the American dream of homeownership feels increasingly out of reach.

Nearly 40% of US renters believe they will never own a home, up from 27% less than a year ago.

Mortgage application rates are at multi-year lows.

And for those who do own a home, the cost of owning it has increased 26% since the pandemic (driven by taxes, insurance, and utilities). Buyers are spending $1,510 a month more than four years earlier.

In summary, we are seeing some promising signs around cooling inflation amid consistent job growth, which may mean rate cuts could be expected as early as the fall. But shaky consumer spending, reduction in savings, and gloomy consumer sentiment means we need to keep a close eye on how the economy continues to evolve.

If you ever want to chat about the labor market or are building something helping the modern-day worker, reach out to jomayra@reachcapital.com!