Workforce Wrap Up: July Edition

A cooling labor market, inevitable rate cuts, and new data on UBI

By: Jomayra Herrera

Happy August and Leo Season to those who celebrate (As a Leo, I definitely do)!

Welcome to July’s workforce wrap up. ICYMI - Workforce Wrap Up aims to give a quick 5-minute download of interesting highlights that happened in our labor market / economy in the past month.

Over the past few months, we’ve been waiting for more conclusive data to give the Fed confidence that it’s time to cut rates before it’s too late (i.e. shift the economy from a soft to a hard landing). I think this month we finally got that signal. But the question is: is it too late?

So with that, let’s see what happened:

Labor market added only 114K jobs in July and unemployment increased by 0.2 percentage points to 4.3%

Job growth was below initial estimates of ~170K and represented a steep decline from the 206K added in June.

Increases in unemployment were concentrated around adult men and Whites. Unemployment for other sub-groups effectively remained the same month over month. The number of unemployed people is now at 7.2 million, a year ago it was 5.9 million.

Job growth was driven by healthcare (55K jobs), construction (25K), and transportation and warehousing (14K). Information lost 20K jobs.

Beyond slowing job growth, the labor market continues to show other signs of cooling, almost ensuring a rate cut in September

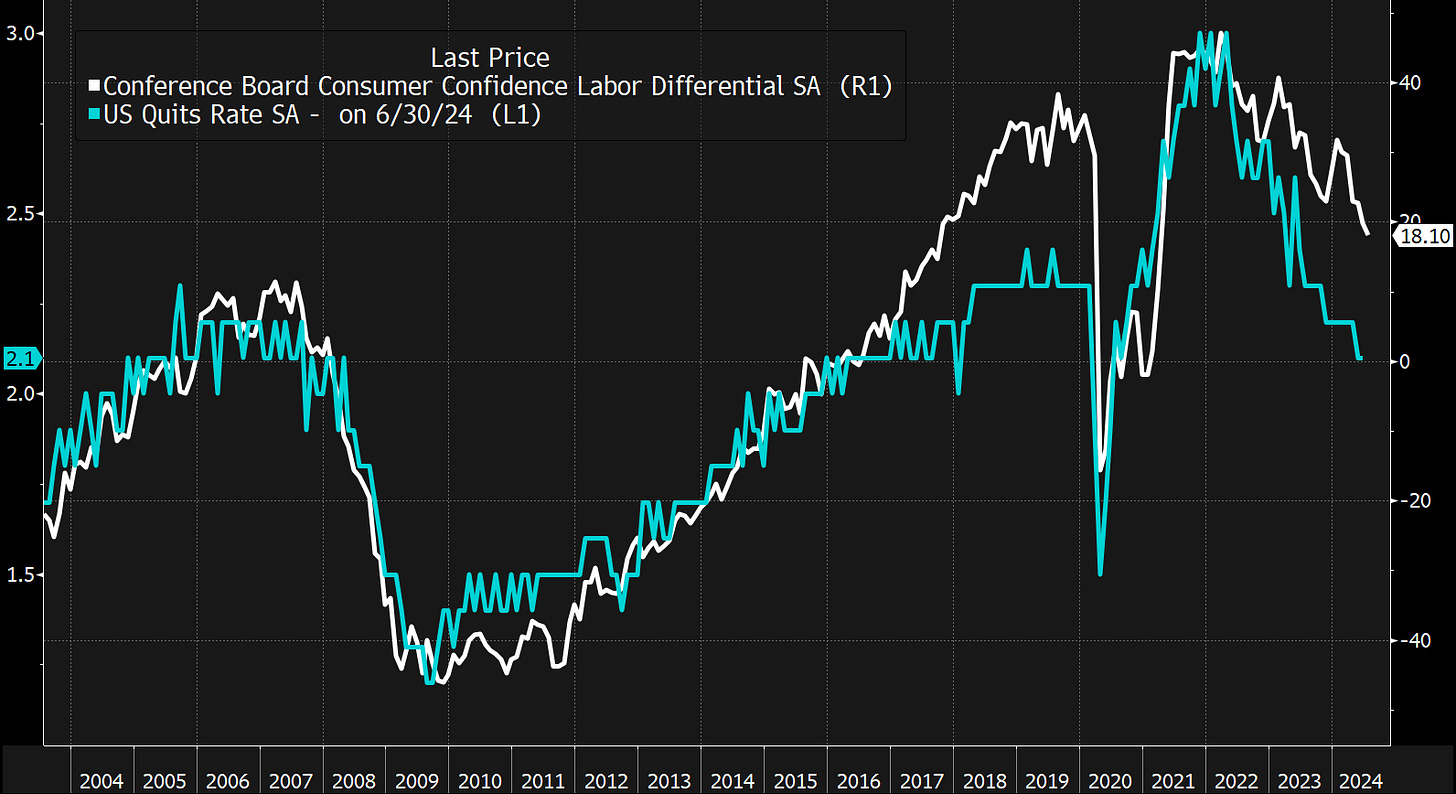

The quits rate, which is usually a good indicator of how confident workers are that they will be able to get another job, held steady at 2.1%, the lowest since August 2020. The chart below shows the quits rate plotted against the Conference Board Consumer confidence in the labor market. Both have been consistently trending down.

The Employment Cost Index (measure for the hourly cost of labor) for workers rose 0.9% (below 1.0% estimates) during Q2, following a 1.2% increase in Q1. During the last year, the 4.1% increase is the slowest since 2021.

Total compensation in the goods-producing industries rose 0.5% in Q2 relative to the service industries which increased 1.0%. Increases in the last year were strongest in transportation & warehousing (7.7% YoY) and education (4.6% YoY).

Initial applications for unemployment benefits increased by 14,000 to 249,000, the highest level in almost a year. Michigan and Missouri were the states with the highest gains.

Goldman economists increased the probability of a US recession in the next 12 months from 15% to 25%.

Fed Chair Jerome Powell said a rate cut in September is “on the table,” provided the inflation data continues to be encouraging. CME’s FedWatch tool is now predicting there will almost certainly be a rate cut at the September meeting.

Reliance on temporary help has decreased significantly, which is typically a precursor to a recession.

Historically, trends in temporary employment were indicative of what was going to happen in the broader job market over the next 6 to 12 months.

Temp employment has declined by 515K jobs since its peak of March 2022 but payroll employment has kept increasing.

Could this be a long-term trend that indicates employers' reticence to rely on temporary workers after the pandemic? Or is there a reason there may be more of a lag in seeing the impact in the broader economy?

Lower-income consumers continue to show signs of strain

Over 15% of all U.S. adults report having unpaid bills, with that number jumping above 25% for renters.

Relatedly, credit card delinquency rates at commercial banks continue to rise.

Personal savings as a percentage of disposable income has declined to 3.5% from 3.8% just last quarter.

But consumer spending was surprisingly resilient

Retail sales were unchanged in June despite a softening labor market. Sales were adversely impacted by a drop in car sales due to a two-week cyber attack on car dealer software company CDK, which created outages at car dealerships. But retail sales excluding auto and gas actually exceeded expectations.

Though there is some pushback on pricing. Jared Berstein, chair of the Council of Economic Advisers, said "As excess savings have largely burnt off, even as real wages and disposable incomes are posting solid gains, the price elasticity of demand appears to have reawakened.”

Fun final thought: we finally have some real data on the implications of Universal Basic Income - and the results seem somewhat positive

OpenResearch and the Harvard Kennedy School both recently released research on the impact of cash transfers in the U.S.

The OpenResearch study followed 3,000 individuals from Illinois and Texas, 1,000 of whom were given $1,000 per month for three years. The in-depth study assessed the impact of the grants on spending, agency, employment, health, moving, and entrepreneurship.

The HKS study followed 2,880 individuals in Chelsea, Massachusetts. 1,748 of them received $200 and $400 per month for nine months, depending on the size of their family. The study was mostly focused on the impact of the cash transfers on health and healthcare utilization.

The OpenResearch study found that while recipients of the grant saw a 52% increase in their incomes after three years, the control group rose by 70%. This was in large part, because they worked an average of 1.3 more hours than the recipient group. The recipient group was also 2 percentage points less likely to be employed, but there was wide variation within the group. For example, recipients under 30 and single parents were more likely to be unemployed. Younger folks were also more likely to enroll in post-secondary education and, as a result, work fewer hours.

The results are mixed, because on one hand you can view that as a sign of a “failure” or as, the authors posit, a sign that those who received the grant had “increased agency” to be more selective about their employment. In the chart below, you can see that the recipient’s household income (including the transfer) was, on average, higher than the control group three years later. This increased amount in income can theoretically allow them to make different choices, including working less.

Most of the increased cash was used for basic necessities and supporting others.

Both studies found that the cash transfers had a positive impact on the recipient families substance use. The Harvard study found that those who received the benefits had 87% fewer emergency department visits related to substance use. In the OpenResearch study, recipients were 20% less likely to report a level of drinking that interfered with their responsibilities and a 53% decrease in days using painkillers not prescribed to them. The benefits were higher for male participants.

The Harvard study also found reduced hospital visits for behavioral health issues.

While both studies found that there were short-term health improvements for recipient families, by the end of the three years in the OpenResearch study the broad health outcomes were effectively the same between the recipient and control groups.

That’s all for this month! See you in September where there will likely be a lot more interesting news coming from the Fed.