Workforce Wrap Up: September Edition

Unexpected job growth, a 45,000 dockworker strike, and housing & childcare shortages

By: Jomayra Herrera

Welcome to Spooky Season and the start of Q4!

It’s time for September’s workforce wrap up. If you’re new here, Workforce Wrap Up aims to give a quick 5-minute download of interesting highlights that happened in our labor market / economy in the past month.

This month, we have some interesting, albeit confusing, data. On one hand, consumer confidence in the labor market has plummeted, there are concerns around an impending childcare cliff and housing shortage, and we had a massive dockworker strike that could’ve been very disruptive. And yet, the labor market surprised us with 254,000 new jobs, stability in layoffs, and an increase in average wages, creating questions about whether the Fed’s 50 bps rate cut was premature.

So with that, let’s dig in.

The U.S. crushed expectations, adding 254,000 jobs in September and the unemployment rate fell from 4.2% to 4.1%.

Forecasts predicted the US only adding 150,000 new jobs last month. Interestingly, Homebase’s measures were most accurate.

Employment in food services and drinking places increased by 69,000, well above the 14,000 average monthly gain over the prior 12 months. Healthcare added 45,000 jobs Large gains were also seen in government, social assistance, and construction.

Continuing the positive trend, August job growth was revised up by 17,000 and July by 55,000, calling into question the narrative of a cooling labor market.

In September, average hourly earnings increased by 13 cents, or 0.4 percent. Over the last 12 months, average hourly earnings increased by 4.0 percent.

Layoff rates remain low with the average number of workers laid off per month at 1.6 million compared to an average of 1.9 million in 2019.

It’s not all good news though - despite the rapid demand for AI and security-related skills, the unemployment rate for IT professionals increased to 6%

The IT unemployment rate has been above the national jobless rate for seven of the last eight months.

Reductions in IT are concentrated in traditional technology roles like managing back-end corporate systems.

According to Indeed, software development IT support job postings are about 30% fewer than they were before the pandemic.

This is driving a massive consumer demand to develop critical AI, security, and cloud-related skills.

ICYMI 45,000 workers at the 14 ports on the Atlantic and Gulf coasts went on strike last week

The strike was largely about disagreements related to wages and automation. On the former, employers agreed to a 62% raise over six years which helped to bring workers back. Their master agreement is now extended to January 15, 2025.

Automation is more tricky as the union has already agreed to some degree of semi-automation in prior contracts. This is a reminder that while a lot of the conversation is around AI coming to replace knowledge workers, there continue to be concerns about automation at the frontline.

Thankfully the strike only lasted three days. Economists estimated that if the strike continued it would cost about $4.3B per week in lost exports and imports, which could have reduced Q4 GDP growth by half a percentage point.

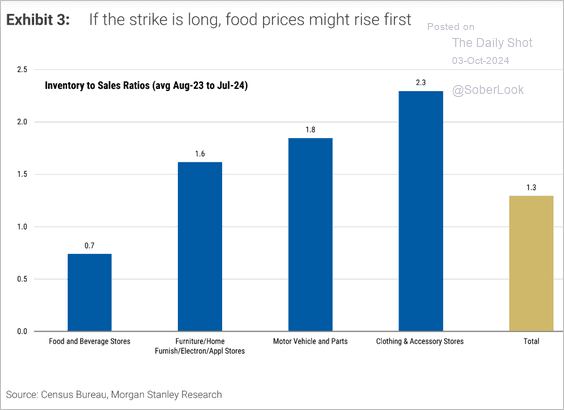

While many retailers stocked up on inventory in advance to avoid any potential disruptions, food and beverage stores were an outlier. There were concerns around potential rises in food if the strikes were to continue.

Consumer confidence declined by the most in three years in September, as Americans are increasingly concerned about the labor market

Consumers are increasingly pessimistic about the economy, largely because of concerns related to employment.

Only 31% of consumers said jobs were plentiful, down 2 points from August, and the share of those who said jobs were “hard to get” increased 1.5 percentage points to 18.3%.

The conference board shared that concerns around inflation are starting to decline, especially relative to employment.

A new report on the state of childcare was released - while the “child care cliff” is less dire than initially predicted, there are still clear signs of increased costs of care, labor shortages, and closure of sites.

Child care prices are increasing faster than overall inflation. In fact, nationally child care prices are 20% higher than they were in 2019.

In forty-five states plus D.C., the average annual price of child care for two children in a center exceeded annual mortgage payments and, in all fifty states plus D.C., it exceeded average annual rent payments.

The childcare challenge is worse for lower income families. A report by the Federal Reserve Bank of Chicago found that in 2021 families below the poverty line spent 27% of their income on care, up from 23% in 2019. Whereas higher income families spent 7% of their income on care in 2021, a decline from 8% in 2019.

There has been a 12 percent decline in licensed family child care homes since 2019, and a small 1.3 percent increase in child care centers.

In the five states the report focused on, licensed child care programs have either declined or flattened since 2019.

In positive news - between 2021 and 2023, eleven states and Washington D.C. spent their own state budget dollars to help stabilize child care. The National Women’s Law Center found that women in those states who had children under the age of 12 and wanted to work but reported not working because of childcare issues decreased by 13 percentage points between fall 2023 and spring 2024.

And lastly, the US is facing a severe housing shortage, which is concerning if rates continue to decline and demand for housing spikes.

In 2005, builders were constructing new homes at a rate of about 2.2 million per year. Now, the number is 1.2 million.

The current housing shortage can be traced back to the 2008 housing crisis when many home builders went out of business and the industry did not recover.

If rates continue to decline and demand spikes, there is not enough supply to meet that demand which will likely only worsen housing affordability issues.

The next Workforce Wrap Up will be a big one - we will have a newly elected president, data on whether the September job uptick was a blip or indicative of a rebound in the market, and whether the Fed will continue cutting rates.

Until then, if you ever want to nerd out on any of this shoot me an email at jomayra@reachcapital.com!